GnS+Research

.https://hubertmoolman.wordpress.com/2016/03/01/gold-price-forecast-gold-and-the-us-monetary-base/

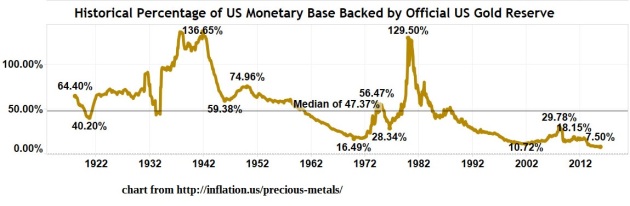

Below is a chart from inflation.us, which illustrates this:

The US monetary base basically reflects the amount of US currency issued. Originally, the monetary base is supposed to be backed by gold available at the Treasury or Federal reserve to redeem the said currency issued by the Federal Reserve. The Federal Reserve does not promise to pay the bearer of US currency gold anymore; however, it does not mean that gold (it’s price and quantity held), relative to the monetary base has become irrelevant.

When the US monetary base gets too big relative to the gold price (& US gold reserves), then market forces seek to correct the situation. This has happened a number of times over the last 100 years, but on two occasions, it was so critical, that the situation actually over-corrected. This was during the 30s and the 70s.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.