Capital formation refers to net additions of capital stock such as equipment, buildings and other intermediate goods. A nation uses capital stock in combination with labour to provide services and produce goods; an increase in this capital stock is known as capital formation.

Just a regular guy (from ware I am on earth) Imagine yourself floating like a satellite. Zoom out to space looking back at earth I look at what each country is doing, zoom in closer to take a look at what the United States (gov.) continues to do, now zoom in even closer as I watch what my community dose and try my best as am individual to make sense of it all.and hopefuly I am smart enough to position my self on the right side of the market:: Gold and Silver+Research with a dash of inspiration.

Wednesday, March 30, 2016

Sunday, March 27, 2016

2017 Friday, January 20 - US Presidential Inauguration

Will the United states maintain its unity until this day with our newly elected President or will Martial law be declared with the current leadership scared for their lives?

Because of the up heal that will eventually arise from within the 48 continental states peacefully and the establishment swallow their pride and dignity and step down?

I think the whole world will need the support of love peace and discipline while the establishment is simply ignored and driven out of existence, while they continue to manipulate the crowds of the uninformed while playing on the fears of the public through the strategy of divide and conquer. The people will continue to be challenged don't let your guard down.

Because of the up heal that will eventually arise from within the 48 continental states peacefully and the establishment swallow their pride and dignity and step down?

I think the whole world will need the support of love peace and discipline while the establishment is simply ignored and driven out of existence, while they continue to manipulate the crowds of the uninformed while playing on the fears of the public through the strategy of divide and conquer. The people will continue to be challenged don't let your guard down.

Saturday, March 26, 2016

Life in Markets

You can watch things happen.

You can make things happen.

Or

You can wonder what the F**k happened

I definetly don't want number 3

-Unknown

You can make things happen.

Or

You can wonder what the F**k happened

I definetly don't want number 3

-Unknown

Market Physcology Confirmed

People Judge only what they See.

A stock market correction in market physcology is already in place as the below charts cofirm a downward trend now it's a matter of time weather the common folk believe it in reality.

People Judge what they See...

Because what they see they think is real but they forget to look at the details befor reality shows up. The average typically forget or neglect the future reality, not sure if the decision they make today is the correct one.

But If they don't beleive what they see or take correct action on their future they may need to educate themselves more untill ready to make the right decision they can live and die with.

It doesn't mean the market will fall out tomorrow but in time a new all time low in stocks not seem in many years will eventually happen and complete.

GnS Research

Random search below

A stock market correction in market physcology is already in place as the below charts cofirm a downward trend now it's a matter of time weather the common folk believe it in reality.

People Judge what they See...

Because what they see they think is real but they forget to look at the details befor reality shows up. The average typically forget or neglect the future reality, not sure if the decision they make today is the correct one.

But If they don't beleive what they see or take correct action on their future they may need to educate themselves more untill ready to make the right decision they can live and die with.

It doesn't mean the market will fall out tomorrow but in time a new all time low in stocks not seem in many years will eventually happen and complete.

GnS Research

Random search below

Thursday, March 24, 2016

The Reload

I sense an erie calm after the unfortunate events in belguim news has seemed to not be news, something is brewing deep.

Peace is smart for the fate of every living thing on earth.

But I beleive a regional war is in process in the middle east and US civil distraction are imminent as we aproach the election cycle. Don't be surprized if Trump is forced to go into the independent party.

GnS Research

Saturday, March 19, 2016

Torpedo To Fair Value

When you think we can not learn from history, but you know you may read about it in the future, why not learn from the past to prepare your future for success rather that the pain of forgetting failure.

If we know in history the gold to silver ratio is 16:1 and we now see that current mining production is 17:1 yet the price is over 70:1 then eventually your suspect to realize that the balance to fair value must take place if we are here @ 70 ounces of Silver to 1 ounce of gold a torpedo to fair value is imminet at current prices US 3/18/2016 from $15.79 Silver Vs Gold $1255.00 Equals just over 79 ounces to purchase just 1 single ounce of gold. fair value with these price @ 16:1 ratio = $78.00 Silver and $1255.00 gold prices @ 2500.00 gold, Silver would be $156.25 measured with the historic 16 to 1 ratio.

GnS Research

“Numbers don’t lie – people do.”

This brings us to the silver market, and some numbers that illustrate some unequivocal truths. There are few better sources for numbers on silver than precious metals icon, Eric Sprott. In a recent interview with The Daily Coin , Sprott provided a few interesting numbers.

Silver is mined at an 11:1 ratio to gold. This is raw data. This becomes significant when we look more raw data numbers: the natural occurrence of these two metals in the Earth’s crust. Silver is approximately 17 times as plentiful as gold. Therefore, all things being equal, we should expect silver to be mined at a near-identical ratio of 17:1.

Instead, silver is under-produced by roughly 50%. How? Why?

We know it could not possibly be due to lack of interest or demand. Historically, over a span of thousands of years, the price ratio between silver and gold was a very steady 15:1. This means that (over thousands of years) humanity has exhibited a slight price preference for silver. It occurs at a 17:1 ratio, but people have been willing to pay for it at a slightly higher 15:1 ratio.

Wednesday, March 16, 2016

Helicopter Money

This was a trickle and now it appears that free money may be a thing of common goods and services what a test this will be for those who like to work and thoes that do not like to work

I learned from my father the power of hard work and that to worry about myself not others, leaning talking and the ones that play games with each other. costing us all time and money.

What a challege it will be for us all when they announce free monies to the world the public and your neibors.

would you quit your job if you had only your income to expenses sustained.

Imagine a conversation with yur friends even the homeless hey get off your but lets go have some fun did you get your check yet "yes" well c'mon then let's enjoy some drinks and hang out everything is paid for

This will be our greatst demise as the influx of currency into the local markets will inflate prices byond what 10, 20 even thirty times as much so we will all need to work anyways.

GnS Reasearch

.http://www.internationalman.com/articles/how-negative-interest-rates-will-turbocharge-the-migrant-crisis

I learned from my father the power of hard work and that to worry about myself not others, leaning talking and the ones that play games with each other. costing us all time and money.

What a challege it will be for us all when they announce free monies to the world the public and your neibors.

would you quit your job if you had only your income to expenses sustained.

Imagine a conversation with yur friends even the homeless hey get off your but lets go have some fun did you get your check yet "yes" well c'mon then let's enjoy some drinks and hang out everything is paid for

This will be our greatst demise as the influx of currency into the local markets will inflate prices byond what 10, 20 even thirty times as much so we will all need to work anyways.

GnS Reasearch

.http://www.internationalman.com/articles/how-negative-interest-rates-will-turbocharge-the-migrant-crisis

I think the latest gimmick to stimulate the economy is pretty much the same thing. It’s one of the most absurd ideas I’ve heard in a while. And that’s saying something, considering the outrageous schemes our economic luminaries have recently come up with, like…

- Faking a space alien invasion to help stimulate the economy.

- Minting a trillion dollar coin.

- Negative interest rates.

- Banning physical cash.

- Cash for clunkers.

- Increasing rounds of money printing, euphemistically called “quantitative easing.”

These ideas would be comical if people in power didn’t actually take them seriously. But they do.

Tuesday, March 15, 2016

March 1933 - US Bank Holiday

Do you think a bank closing its doors for restructuring (bankruptcy0 are impossible??

Did you know that banks have shut their doors to the public before

Take note that in 1933 president Roosevelt through executive order had the banks closed jus 36 hours after taking the oath of office!

.http://www.federalreservehistory.org/Events/DetailView/22

At 1:00 a.m. on Monday, March 6, President Roosevelt issued Proclamation 2039 ordering the suspension of all banking transactions, effective immediately. He had taken the oath of office only thirty-six hours earlier.

Did you know that banks have shut their doors to the public before

Take note that in 1933 president Roosevelt through executive order had the banks closed jus 36 hours after taking the oath of office!

.http://www.federalreservehistory.org/Events/DetailView/22

At 1:00 a.m. on Monday, March 6, President Roosevelt issued Proclamation 2039 ordering the suspension of all banking transactions, effective immediately. He had taken the oath of office only thirty-six hours earlier.

Tuesday, March 1, 2016

Every 40 Years Gold/Inflation 2020 & 2021 Top

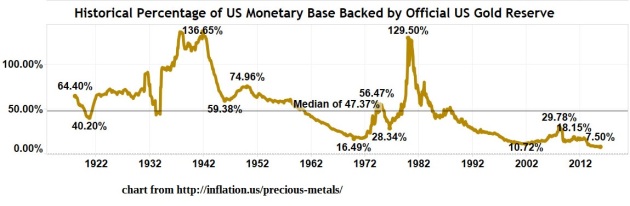

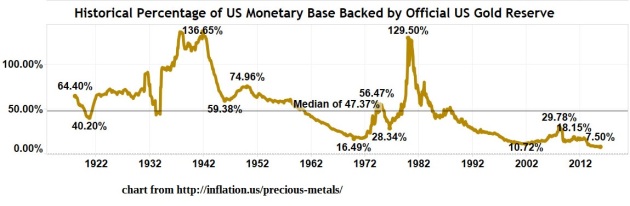

According to this chart it appears very 40 years gold tends to correct the monetary supply and we're currently at historical lows 2020 & 2021 look like the next peak (Top)

GnS+Research

.https://hubertmoolman.wordpress.com/2016/03/01/gold-price-forecast-gold-and-the-us-monetary-base/

GnS+Research

.https://hubertmoolman.wordpress.com/2016/03/01/gold-price-forecast-gold-and-the-us-monetary-base/

Below is a chart from inflation.us, which illustrates this:

The US monetary base basically reflects the amount of US currency issued. Originally, the monetary base is supposed to be backed by gold available at the Treasury or Federal reserve to redeem the said currency issued by the Federal Reserve. The Federal Reserve does not promise to pay the bearer of US currency gold anymore; however, it does not mean that gold (it’s price and quantity held), relative to the monetary base has become irrelevant.

When the US monetary base gets too big relative to the gold price (& US gold reserves), then market forces seek to correct the situation. This has happened a number of times over the last 100 years, but on two occasions, it was so critical, that the situation actually over-corrected. This was during the 30s and the 70s.

Subscribe to:

Comments (Atom)