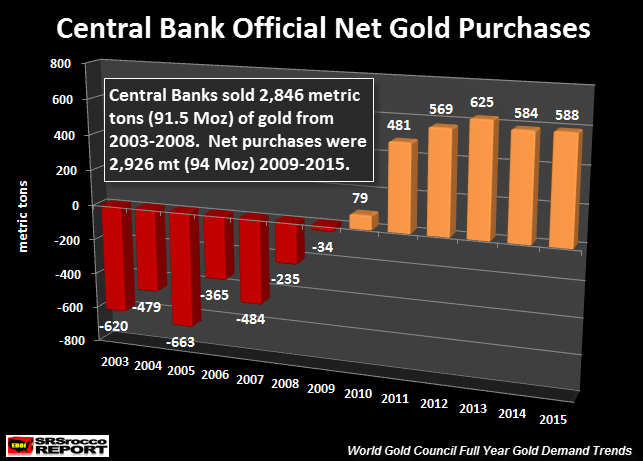

As you can also see with this chart below the pivotal point was in 2008 which lead to gold sales slowing and ceasing in 2009 and net purchases began in 2010.

Why are central banks are buying the physical metal if they can produce monetary instruments with accounting procedures. In my view it looks like the central banks have been buying assurance of gold and with lower prices globally it suggests to me that gold is not expensive enough to cover outstanding debts and obligations public and private

I am curious but I do not provide finical advise I ask my readers this: "If central banks are now proven to be net buyers of gold and it appears t be in greater demand have you also made a decision to hold something like gold at a current discounted rate?

GnS+Research

Central Bank gold sales peaked in 2005 at 663 mt and accounted for 21% of total demand that year. What would have been the market price of gold if the Central Banks didn’t dump 91.5 Moz over the seven-year period (2003-2009)?

Then something changed in 2010. As the United States and other Western Central Banks (Japan & then the EU) continued their massive QE (Quantitative Easing – money printing) policies, Eastern and various Central Banks became net buyers of gold.

Net Central Bank gold buying started at only 79 mt in 2010, surged to 625 mt in 2011 and is estimated to be 588 mt for 2015. Again, the majority of Central Bank gold purchases were from Eastern governments, especially in 2015. Russia and China accounted for majority of Central Bank gold purchases last year.

What a trend change… aye? From 2003-2009, Central Banks dumped 91.5 Moz of gold into the market. However, this totally reversed as Central Banks were net buyers, acquiring 94 Moz of gold from 2010-2015.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.