Ask yourself what happens when the system you use to measure the cost of goods like food water housing and clothing changes.

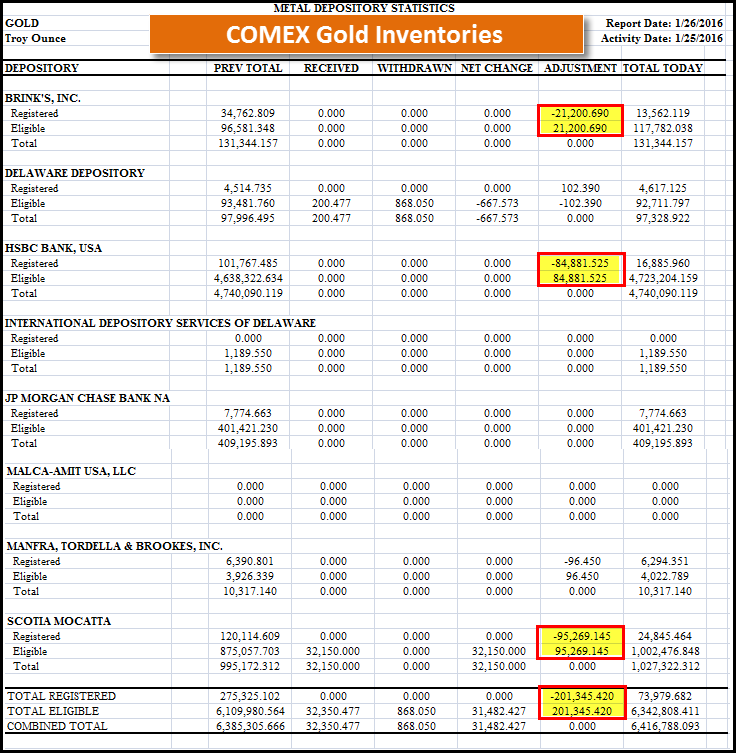

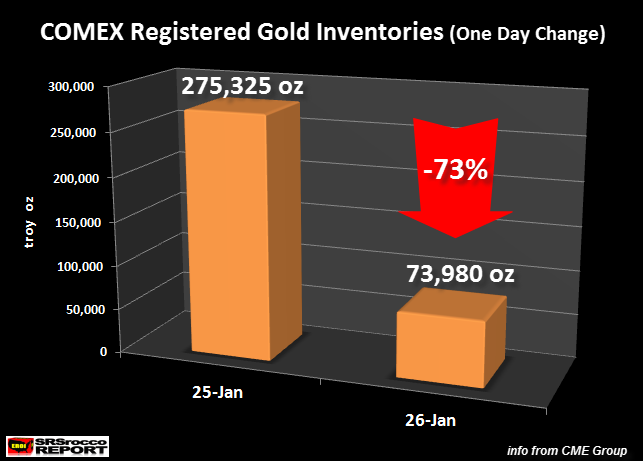

Specifically for precious metals.

So for instance when the the COMEX (Chicago Mercantile Exchange) closes and the Metals are no longer measured with the US global dollar instead a different platform is used such as the Chinese Yuan.

If a different platform is used a new formula will need to be developed to calculate the correct price in the currency one posses (uses) to buy

You will need to know the exchange rate of one currency to the other like many of the countries currently do except if you live in the United States then you have had the luxury of not needing this formula.

This my friends I believe will change sooner rather than later although it will be in phases most Americans do not see their so called king dollar loosing value anytime some but soon when every other country chooses not to participate with this debt @ 20 Trillion then the American dollar won't be worth anything it is worth today.

Slow and steady change on November 30th 2015 the Chinese Yuan was treated to the 5 Global Reserve currencies through the IMF this will be activated October 1 - 16th 2016.

This will lead to more Chinese influence and less US influence as the corrupt government continues wars to defend it's currency

We are walking through the global transition of the transfer of power from the kings of the west US & Europe to the kings of the east (Russia & China) which complete prophetically 2017 - 2018

I will always try to remember gods money is Gold & Silver

Do your best to see it this way and your whole world will change.

Debt is not money it is credit and digital currency.

GnS + Research